Sponsored by: First Step Growth

Building something ambitious in healthcare? First Step Growth helps founders turn traction into scalable ROI.

We’re an operator-led growth marketing agency specializing in paid acquisition on Google and Meta, building repeatable systems that drive qualified customers and measurable growth. 👉 Click here to book an intro call!

Now, here’s what we have this week:

Epic rolls out an AI scribe

Google raises the bar for evidence in healthcare AI

New York digital health 100

20 new tools/partnerships, 9 funding updates, new AI jobs & link-worthy content

Read time: 5 minutes

Our Picks ✨

Highlights if you’ve only got 2 minutes…

1/

Epic rolls out an AI scribe

Epic just rolled out AI Charting, its long awaited ambient AI scribe built directly into the EHR, and it does more than just take notes. The tool listens during visits, drafts notes in real time, and suggests orders based on the clinician patient conversation, all while letting clinicians customize note structure using voice commands.

AI Charting sits inside Epic’s broader AI suite, Art, which is already seeing heavy usage. Epic says its pre visit chart summarization tool is now used more than 16 million times per month, nearly triple since late 2025. On the operations side, Epic’s AI for billing and denial appeals is helping organizations cut coding related denials by more than 20%.

With over 40% of US hospitals on Epic and 2/3 already using ambient AI, distribution is Epic’s biggest advantage. The question now is whether Epic’s native approach can match the depth and specialization of standalone AI scribe vendors. Epic’s entry changes the buying calculus for late adopters, but it does not end the ambient AI market. Distribution and bundling will win some deals fast, while specialized vendors (Abridge, Ambience, Nabla, etc) still have room to win where depth, safety, and specialty focus matter most. (link)(linkedin)

2/

Google raises the bar for evidence in healthcare AI

Google is taking a more rigorous step into healthcare AI with a nationwide randomized study evaluating conversational AI in real world virtual care. In partnership with Included Health, the company will test how its medical AI performs inside live virtual care workflows vs. simulated settings or retrospective reviews.

The trial will recruit consented patients across the US and compare AI supported interactions with standard clinical practice. The goal is to understand not just accuracy, but safety, clinician experience, and where AI meaningfully helps or falls short when managing real patient conversations at scale.

This study builds on years of prior research, including Google’s AMIE work that showed physician level performance in simulated primary care. The shift here is evidence. By moving into a large randomized trial, Google is helping set a higher bar for how medical AI should be tested before broad clinical deployment. Healthcare AI will benefit from trials like this to scale properly. (link)(linkedin)

3/

New York digital health 100

The New York Digital Health 100 is back for its seventh year, highlighting the startups shaping the future of healthtech across the region. The 2026 list features 48 new companies, with healthcare AI taking center stage as founders tackle everything from administrative burden to care delivery and life sciences.

In 2025, 126 NYC healthcare companies raised $4.8B, up 20% year over year. Late stage rounds dominated, accounting for 71% of funding, while early stage investment also ticked up to 29%. Investors continue to favor scalable infrastructure, with administrative efficiency leading all categories at 25% of total funding, followed by life sciences at 18% and care delivery and coordination at 14%. New York really is a hot spot for digital health and health AI its showing up in the numbers. (link)(linkedin)

Tools & Partnerships 🔧

Latest on business, consumer, and clinical healthcare AI tools and partnerships…

TOOLS

Report sparks speculation Oracle may sell Cerner to fund AI buildout: A TD Cowen note suggests Oracle could offload Oracle Health to help finance massive AI datacenter commitments, raising the prospect of a major EHR market shakeup. (link)

OpenAI launches Frontier to manage enterprise AI agents: OpenAI introduced Frontier, a platform for building, deploying, and governing AI agents at scale across enterprise systems. Frontier focuses on shared context, permissions, evaluation, and real-world task execution, with early adopters including Oracle, Thermo Fisher, Abridge and others. (link)

Optum rolls out AI-powered prior auth tools: Optum launched new AI tools designed to automate prior authorization workflows for payers and providers, aiming to reduce delays and administrative friction. (link)

Sword Health upgrades Phoenix AI care agent: Sword Health announced a major update to its Phoenix AI agent, adding proactive care, long-term clinical memory, wearable integration, and proprietary clinical models. (link)

HHS develops AI to analyze vaccine safety data: HHS is building an AI tool to analyze vaccine monitoring databases and generate hypotheses about potential adverse effects, according to Wired. (link)

Fitbit founders launch family-focused AI health app: Fitbit co-founders unveiled Luffu, an AI app that aggregates health data across families, supporting natural-language queries and caregiver-focused monitoring. (link)

Oracle Health expands clinical AI agent capabilities: Oracle Health expanded its clinical AI agent to support more workflows inside the EHR, focusing on documentation, insights, and task automation. (link)

Report says Apple scales back AI health coaching plans: Bloomberg reported Apple has pulled back on plans for a standalone AI health coach, signaling a more cautious approach to consumer-facing medical guidance. (link)

Infinitus launches agentic AI for health plans: Infinitus introduced new agentic AI tools to support health plans with member services, automating inbound and outbound calls while operating within strict compliance guardrails. (link)

CommonSpirit expands AI footprint to 242 deployments: CommonSpirit Health reported it now has 242 AI use cases live across its system, reflecting growing scale and operational integration. (link)

EchoJEPA trains on 18M heart ultrasound videos: Researchers introduced EchoJEPA, a foundation model trained on 18 million cardiac ultrasound videos that learns heart structure rather than pixels, marking one of the first JEPA-style models at medical video scale. (link)

Physician ratings favor DoxGPT in complex specialties: A Doximity led study of 1,315 physician evaluations found most clinical AI tools perform similarly, but DoxGPT was preferred more than 2x as often in higher-complexity specialties like cardiology and oncology. (link)

PARTNERSHIPS

M Health Fairview + Nabla: M Health Fairview selected Nabla’s ambient AI scribe for systemwide deployment to reduce documentation burden and support clinician workflows. (link)

Humana + Google Cloud: Humana is expanding its partnership with Google Cloud to deploy an AI-powered Agent Assist tool that supports customer service and care operations. (link)

MultiCare Health System + Ambience Healthcare: MultiCare is deploying Ambience’s ambient AI documentation platform enterprise-wide to streamline clinician workflows. (link)

Prosper AI + Firstsource: Prosper AI partnered with Firstsource to power agentic voice AI across its revenue cycle operations, supporting deployment across 1,000 plus hospitals, ambulatory groups, and a 30,000 employee workforce. (link)

Anthropic + Allen Institute + Howard Hughes Medical Institute: Anthropic partnered with the Allen Institute and HHMI to use Claude as a research assistant and develop agentic tools for scientific discovery. (link)

AtlantiCare + Opmed.ai: AtlantiCare deployed Opmed.ai to optimize surgical scheduling using AI-driven operating room planning. (link)

Oath Surgical + NVIDIA: Oath Surgical partnered with NVIDIA to power ambient intelligence for no-documentation outpatient surgery facilities. (link)

Suki + athenahealth: Suki was selected by athenahealth as its preferred ambient intelligence partner for AI-driven clinical documentation. (link)

Deal Desk 💰

Spotlight on latest capital raises, M&A, and investments…

FUNDING

Midi Health, an LA-based women's midlife healthcare company, raised $100M in Series D funding at a valuation north of $1B. Goodwater Capital led. (link)

Chamber, a cardiology-focused tech platform for VBC models, raised $60M in Series A equity and debt funding. Frist Cressey Ventures led. (link)

Alaffia Health, an NYC-based agentic AI platform designed to manage health plan claims, raised $55M in Series B funding. Transformation Capital led the round and was joined by FirstMark Capital, Tau Ventures, and Twine Ventures. (link)

Biorce, a Barcelona, Spain-based company using AI to change how clinical trials are designed and conducted, raised $52M in Series A funding from DST Global Partners, Mustard Seed Maze, and existing investors. (link)

Lotus Health AI, a San Francisco-based developer of an AI doctor platform, raised $35M in Series A funding. CRV and Kleiner Perkins led the round. (link)

Synthpop, a Cambridge, Mass.-based agentic AI platform designed to automate health care workflows, raised $15M in Series A funding. Ansa Capital led the round and was joined by others. (link)

Phylo, a research lab studying agentic biology, raised $13.5M in seed funding co-led by Andreessen Horowitz and Menlo Ventures / Anthology Fund with Anthropic. (link)

Graici, a Cleveland-based Medicaid renewal and redetermination solutions provider, raised a $7.5M Series A led by Santé Ventures. (link)

Linda AI, a London, U.K.-based developer of agentic AI technology for dental practices, raised $3M in pre-seed funding. (link)

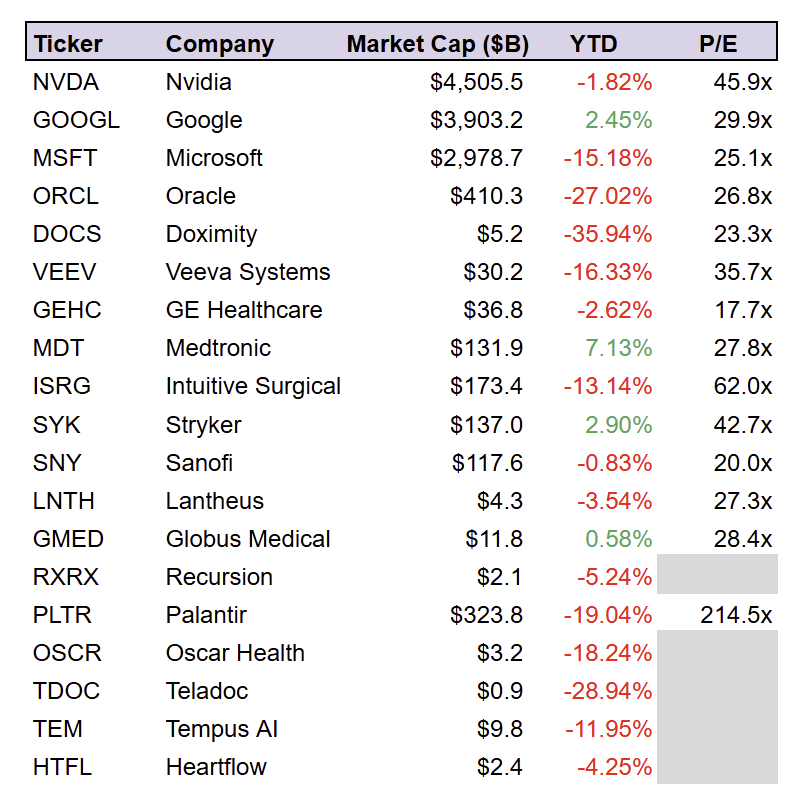

Stay on top of the healthcare AI market and track our portfolio 📈

as of 2/8/26

Other Relevant News 🔍

News, podcasts, blogs, tweets, resources, etc…

AI Job Opportunities 💼

Explore our AI Job Board or contact us to feature roles in our newsletter…

Visuals of the Week 📸

Funny memes, cool pics, and interesting data from around the web…

That’s it for this week friends! Back to reading — I’ll see you next week.

Stay classy,

PS. I write this newsletter for you. So if you have any suggestions or questions, feel free to reply to this email and let me know

How was this week's newsletter? Tap your choice below👇