Hey all —

We already ran out of hats for our first members, BUT we still wanted to do something special for the holidays… so here’s our 🎉 Black Friday Offer:

For one week only, you can get 50% off Healthcare AI Guy PRO.

PRO is our complete suite of tools, data, and resources to stay ahead in healthcare and AI. Explore emerging companies and investors, join an active community, access leading research, and track market trends: all in one place. See you inside!

Have a great Thanksgiving week! 🦃

Now, let’s get to it:

Function Health raises $298M

Gemini 3 outperforms radiology residents

White House moves to override state AI laws

17 new tools/partnerships, 14 funding updates, new AI jobs & link-worthy content

Read time: 5 minutes

Our Picks ✨

Highlights if you’ve only got 2 minutes…

1/

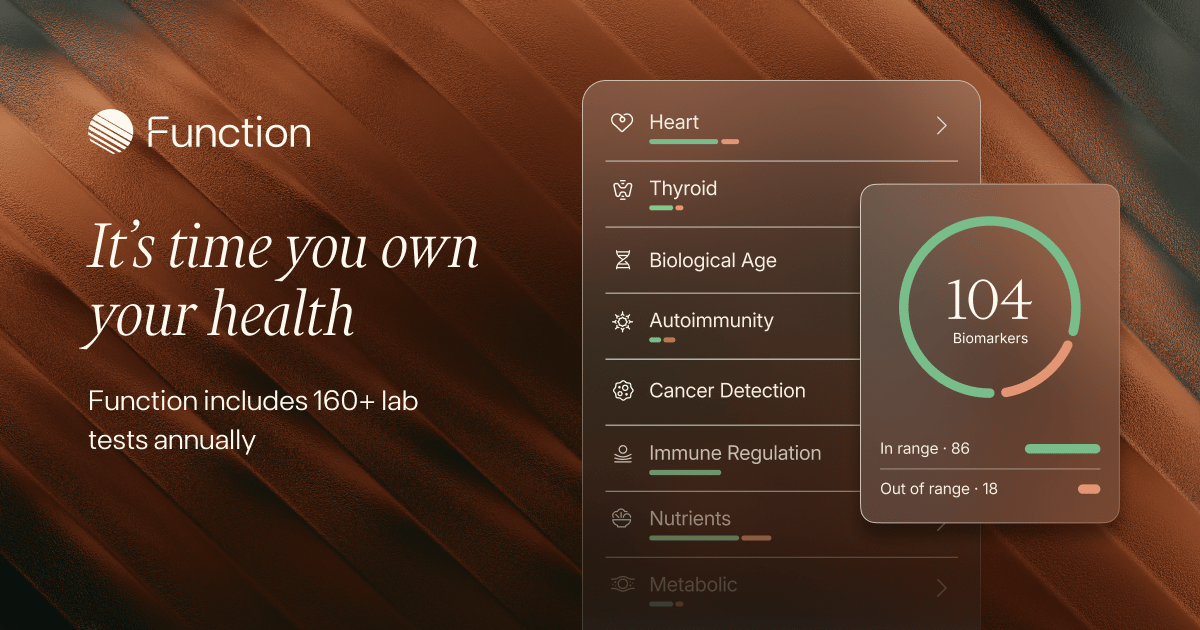

Function Health raises $298M

Function Health just became one of the fastest-growing consumer health companies, securing a $298M Series B at a $2.5B valuation. The company offers 160+ biomarker tests plus AI-powered full-body scans through its Ezra acquisition, far beyond the ~26 markers measured in a typical annual physical. Function has now run more than 50M tests since launch. At its new valuation, Function now sits at roughly 12% the value of Quest Diagnostics.

Its big announcement is the Medical Intelligence Lab, a generative AI system that unifies labs, imaging, wearables and medical records to surface early warning signals and give members personalized insights. Function also dropped its membership price from $500 to $365. Competitor Superpower cut pricing to $199 earlier this year, raising questions about price sensitivity and future margin pressure. There are still debates about over-testing and clinical value, but the broader trend is clear: the preventive-care wave is accelerating, and Function is becoming one of its primary engines. (link)(tweet)

2/

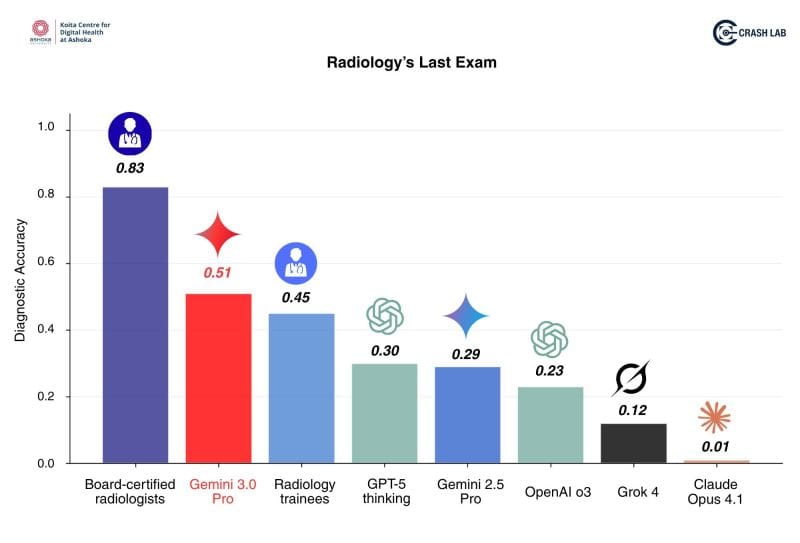

Gemini 3 outperforms radiology residents

Google is back on top of the AI race following its new Gemini 3 launch. On top of leading benchmark results, it was trained entirely on Google’s own TPUs, a strategic move that lets Google scale without fighting the industry for Nvidia GPUs.

On the healthcare side, Gemini 3 Pro just became the first general-purpose AI model to outperform radiology trainees on Radiology’s Last Exam. It scored 51% accuracy compared with residents at 45%. Board-certified radiologists still sit at roughly 83%, but this is a meaningful milestone. A broad frontier model is now performing at the level of early-stage human clinicians on a real imaging assessment.

Gemini also shows clean, step-by-step reasoning on tough cases like appendix localization and distractor mimics. It is still early days, but AI is moving fast toward measurable clinical competency. As they say, today’s model is the worst AI model you’ll ever use for the rest of your life. Onwards! (link)(linkedin)

3/

White House moves to override state AI laws

A leaked draft executive order shows the Trump administration preparing to crack down on states that pass their own AI laws. The plan would let the DOJ sue states like California and Colorado, block them from receiving remaining broadband funds, and push agencies to tie federal grants to states abandoning AI regulations. It also calls for a national AI framework that would override state rules entirely.

The move lands after more than a thousand state AI bills created a growing patchwork of conflicting requirements. That maze has become a major drag on startups and high-stakes sectors like healthcare, where AI tools are already improving access and efficiency. Federal preemption is politically explosive, but AI can’t flourish under 50 incompatible rulebooks. As we’ve called for in the past, a unified national standard might be the only practical path forward. (link)

Tools & Partnerships 🔧

Latest on business, consumer, and clinical healthcare AI tools and partnerships…

TOOLS

Cigna launches Clearity transparent health plan: Cigna introduced Clearity, a new plan built around cost transparency and powered by AI and data tools to help members understand coverage. (link)

Aetna introduces conversational AI navigator for members: Aetna launched a conversational AI tool that helps members navigate care options, understand benefits, and access support through natural language queries. (link)

Elsevier launches LeapSpace AI for researchers: Elsevier introduced LeapSpace, an AI-assisted workspace for scientists to plan projects, explore literature, and find collaborators, built on ScienceDirect and Scopus and launching in Q126. (link)

VA rolls out AI scribes at 10 hospitals: The Veterans Health Administration is piloting ambient AI scribe tools from Knowtex and Abridge at 10 medical centers to transcribe and draft clinical notes automatically. (link)

UpToDate Expert AI adds Lexidrug for deeper drug support: Wolters Kluwer expanded its GenAI clinical tool with Lexidrug’s database of 3,000 vetted medication topics, improving answers to the drug-related questions that make up roughly 30% of clinician queries. (link)

Nabla Bio designs therapeutic antibodies with AI: Nabla Bio introduced JAM-2, an AI model that designs drug-quality antibodies directly on computers with strong early success rates. (link)

Chai Discovery reports 86% success in AI antibody design: Chai Discovery’s Chai-2 model achieved an 86% success rate in generating antibodies with drug-quality properties in recent testing. (link)

Pyx Health rolls out AI-powered Navigator for Medicaid and SNAP: Pyx Health launched an AI tool to guide members through benefit changes, providing real-time updates and personalized support. (link)

Infinitus unveils agentic AI tool for pharma-to-consumer strategies: Infinitus released an AI agent to support pharmaceutical direct-to-consumer outreach by automating workflows and personalizing engagement. (link)

CHOP goes live with Epic generative AI text tool: Children’s Hospital of Philadelphia implemented Epic’s generative AI tool to convert free-text notes into structured phenotype data for precision-medicine workflows. (link)

PARTNERSHIPS

Anthropic + Microsoft + NVIDIA: Anthropic expanded access to Claude, making it the only frontier model available on AWS, Azure, and Google Cloud through new partnerships with Microsoft and NVIDIA. (link)

Humana + Epic: Humana and Epic are partnering to automate insurance verification and patient check-in, reducing administrative steps for providers and patients. (link)

Mount Sinai + NVIDIA: Mount Sinai launched a three-year AI partnership with NVIDIA to advance research within the ARC innovation network. (link)

AdventHealth + HelloCare: AdventHealth is deploying Virtual Care Smart Rooms powered by HelloCare to enhance patient engagement and give clinicians AI-enabled monitoring and remote rounding tools. (link)

AHA + Dandelion Health: The AHA released AI governance guidance with Dandelion Health, outlining principles for strategic alignment, ethical review, effectiveness, and financial evaluation of healthcare AI. (link)

Google Cloud + Conifer Health Solutions: Conifer is building an AI revenue cycle platform on Google Cloud, integrating directly into its RCM workflows to automate key processes. (link)

UnityPoint Health + Mayo Clinic: UnityPoint Health became the first health system to join Mayo Clinic’s new Platform Insights AI network, supporting shared development of clinical AI tools. (link)

Deal Desk 💰

Spotlight on latest capital raises, M&A, and investments…

FUNDING

Function Health, an Austin, Texas-based longevity startup, raised $298M in Series B funding at a $2.5B post-money valuation. Redpoint Ventures led, joined by a16z, FirstMark, Battery Ventures and Menlo Ventures. (link)

RapidSOS, an emergency response platform, raised $100M led by the Apax Digital Funds. (link)

Arbiter, an AI-powered care orchestration platform, raised $52M in seed funding at a $400M valuation. (link)

Voize, a German developer of AI scribes for skilled nursing facilities, raised $50M in Series A funding. Balderton Capital led, joined by HV Capital, Redalpine and Y Combinator. (link)

Sorcero, an agentic marketing platform for pharma, raised $42.5M in Series B funding. NewSpring Capital led, joined by Leawood Venture Capital and Blu Ventures. (link)

Voio, a Berkeley, Calif.-based developer of unified reading tools for radiologists, raised $8.6M in seed funding from Laude Ventures and The House Fund. (link)

alphaXiv, a San Francisco-based platform that curates AI research, benchmarks, and models, raised $7M in seed funding. Menlo Ventures and Haystack led the round and were joined by Shakti VC, Conviction Embed, Upfront Ventures, and angel investors. (link)

Synthio Labs, a San Francisco-based conversational AI platform designed for customer engagement in life sciences, raised $5M in seed funding. Elevation Capital led the round. (link)

Ember, a San Francisco-based AI-powered revenue cycle management platform for health care, raised $4.3M in seed funding. Nexus Venture Partners and Y Combinator led the round. (link)

Annie, a developer of an AI model for dental practices, raised $4M in seed funding. (link)

No Barrier, AI-powered medical translation redefining language access in healthcare, raised a $2.7M seed round led by A-Squared Ventures, Esplanade Ventures, Rock Health Capital and Fusion. (link)

Sandy Health, an AI-powered healthcare operations platform, raised a pre-seed round. (link)

MERGERS & ACQUISTIONS

GE Healthcare + Intelerad: The acquisition adds Intelerad’s cloud-first radiology platform to GE’s imaging portfolio, expanding its AI-enabled ecosystem and accelerating its cloud push toward 2028. (link)

Get Well + RythmX AI: SymphonyAI is merging it’s Get Well and RhythmX AI businesses to create GW RhythmX, a unified precision-care platform. The company says it will use AI to enhance care delivery, patient engagement, and financial outcomes. (link)

as of 11/23/25

AI Job Opportunities 💼

Explore our AI Job Board or contact us to feature roles in our newsletter…

Visuals of the Week 📸

Funny memes, cool pics, and interesting data from around the web…

That’s it for this week friends! Back to reading — I’ll see you next week.

Stay classy,

PS. I write this newsletter for you. So if you have any suggestions or questions, feel free to reply to this email and let me know

How was this week's newsletter? Tap your choice below👇