Welcome back, readers —

If you’re new around here, every week I share the best stories and breakthroughs in healthcare AI that I saw in the past 7 days.

I scroll, so you don’t have to.

Let’s get to it:

Amazon’s new health AI tool

Bessemer’s state of health AI 2026

OpenEvidence’s continued rise

10 new tools/partnerships, 9 funding updates, new AI jobs & link-worthy content

Read time: 5 minutes

Our Picks ✨

Highlights if you’ve only got 2 minutes…

1/

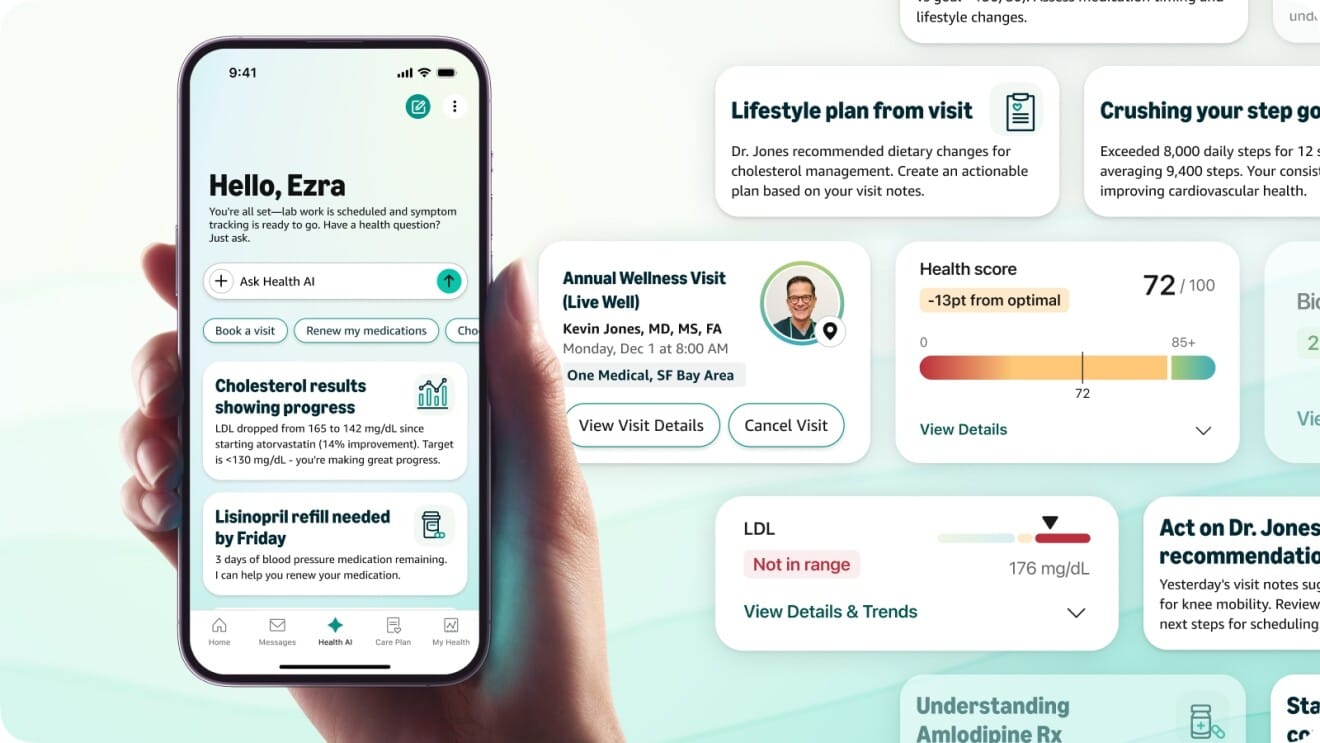

Amazon’s new health AI tool

If healthcare AI wasn’t already busy enough in early 2026 with launches from OpenAI, Anthropic, Doctronic, and more, Amazon just jumped in too. Amazon One Medical rolled out a new agentic Health AI assistant to its 1M+ members, bringing personalized health support directly into its primary care app. The assistant pulls from a member’s medical records, labs, and medications to answer questions, explain results, manage prescriptions, and book same or next day appointments, without requiring users to upload data themselves.

The key shift is that this goes beyond chat and into action. Health AI can route patients to virtual or in person care, message providers, and handle medication renewals through Amazon Pharmacy when appropriate. Clinical guardrails are built in, with automatic escalation to human clinicians for urgent or sensitive cases.

Powered by models on Amazon Bedrock (likely Anthropic?) and developed with One Medical’s clinical team, the assistant is HIPAA compliant and now live for all members. Expect more incumbents to roll out similar tools as AI becomes a default layer in everyday healthcare. (link)(linkedin)

2/

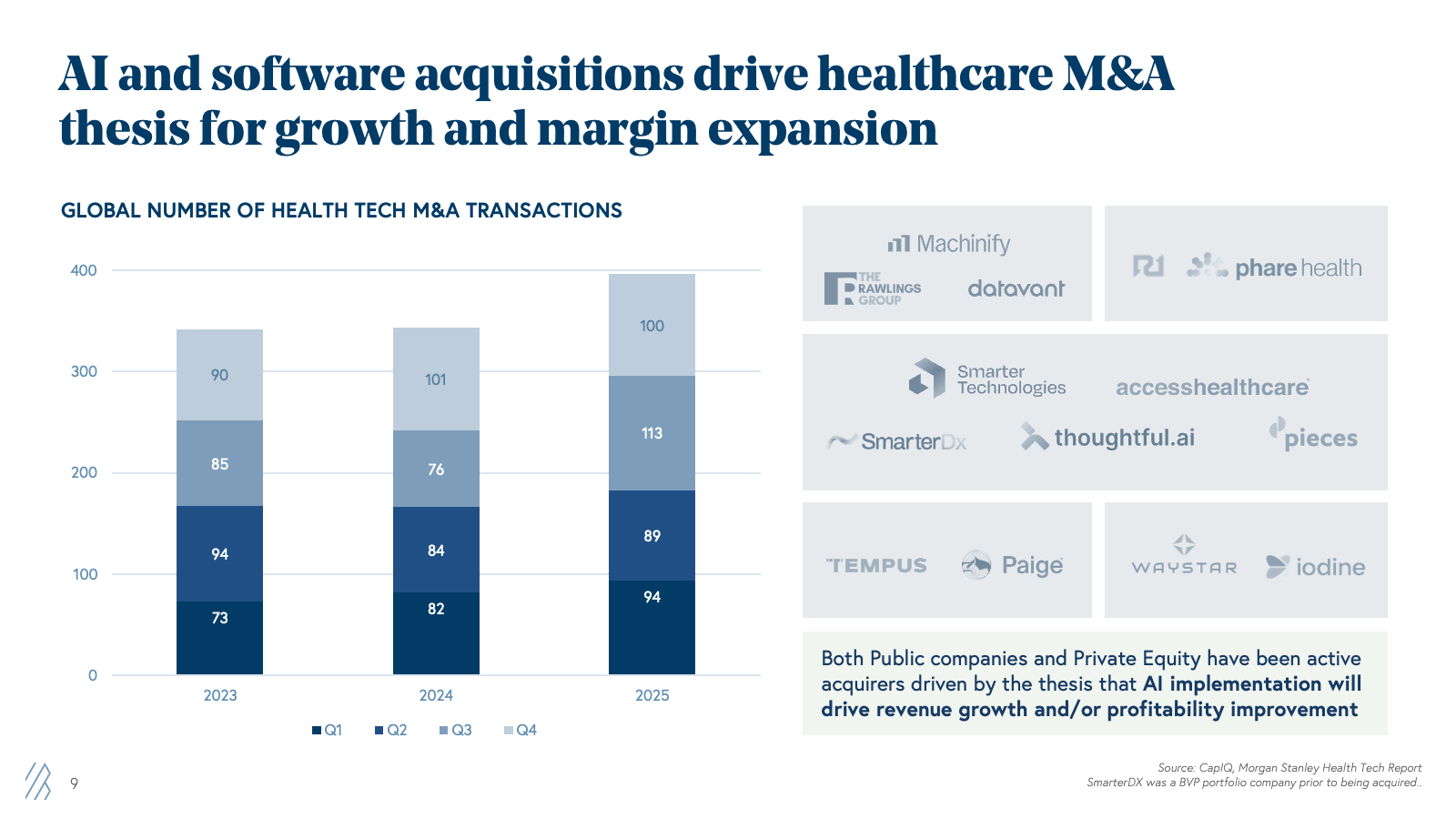

Bessemer’s state of health AI 2026

Bessemer’s new State of Health AI 2026 argues that the healthcare AI wave looks more durable than past healthtech cycles because AI is turning point solutions into core infrastructure. The shift is toward AI delivered as services with software economics. New companies are producing human-quality work while targeting 70% to 80%+ gross margins, unlocking revenue streams that older healthcare software could not touch.

Adoption is also moving at record speed. AI-powered ambient scribes are the clearest proof point. While EHRs took roughly 15 years to scale, scribes reached near-universal adoption in just two to three years, with 92% of provider systems already live, piloting, or deploying. Buyers are pulling these tools in because the ROI is penciling out, with early users reporting 10% to 15% revenue capture gains in year one.

Most telling, clinicians are not being forced to use AI. They are actively asking for it. With more than $1T in administrative waste still in the system, AI is beginning to pay for itself by removing friction from everyday clinical work. The report also lays out seven predictions for 2026, including payers racing to modernize admin ops, more clinician-in-the-loop triage tools, early CMS experiments on clinical AI payment, and a new wave of data infrastructure startups. (link)(linkedin)

3/

OpenEvidence’s continued rise

OpenEvidence just raised a $250M Series D at a $12B valuation, reinforcing its position as one of the most valuable and widely used AI platforms in clinical care. Its medical search engine is now used by more than 40% of physicians across 10,000+ hospitals, helping clinicians find citation-backed answers from peer-reviewed medical literature (they have formal partnerships with groups like NEJM, the AMA, and NCCN, which has helped it earn clinician trust).

The growth curve is hard to ignore. Monthly clinical consults grew from roughly 2.6M in December 2024 to nearly 18M a year later, and the company reached a $100M annual revenue run rate shortly after turning on ads. Over the past year, it has raised roughly $635M across four rounds, with its valuation increasing 12x from $1B in Feb 2025 to $12B in Dec 2025. Early Series A investors like Sequoia reportedly saw near-10x gains in under a year, while CEO Daniel Nadler still owns a majority stake.

OpenEvidence is betting that trusted, specialized AI can become core infrastructure for everyday clinical decision making and is using the new funding to expand its multi-model architecture, using specialized medical AI agents to support everyday clinical decision making. (link)(linkedin)

Tools & Partnerships 🔧

Latest on business, consumer, and clinical healthcare AI tools and partnerships…

TOOLS

Anthropic adds Claude health integrations starting with Apple Health: Anthropic released new integrations connecting Claude to consumer and clinical health data sources, including Apple Health, Health Connect, HealthEx, and Function Health. (link)

Penn Medicine launches Chart Hero inside Epic: Penn Medicine debuted Chart Hero, a GenAI sidebar in Epic that lets clinicians query the chart and surface key patient context and suggested next steps in minutes, with plans to expand to patient pre-visit input. (link)

FDA clears 11 new indications for Aidoc CT triage AI: Aidoc received FDA clearance for 11 additional indications, expanding its body CT triage solution to 14 total and enabling queue-based prioritization for acute conditions. The new tools, powered by its CARE foundation model, reported 97% sensitivity and 98% specificity. (link)

CMS sets 2026 goalposts to accelerate patient AI tools: CMS outlined major 2026 targets to boost interoperability and expand patient-facing AI, aiming to push more private-sector innovation into Medicare workflows. (link)

ARPA-H targets clinical AI agents with 3-year FDA timeline: ARPA-H is seeking proposals to build agentic AI assistants for clinical care and hopes to establish a faster FDA pathway for generative AI in high-risk medical settings. (link)

Study finds hidden prompts can manipulate LLM peer review: A JAMA Network Open study showed that invisible text embedded in manuscripts can push LLMs toward acceptance decisions and reduce their ability to spot scientific flaws, even with stricter prompting. (link)

Survey finds large health systems more worried about AI privacy risk: A Wolters Kluwer survey of 518 hospital leaders found concern over AI-related data breaches and privacy rises with system size, with 57% of leaders at 25,000+ employee systems ranking breaches as a top risk and CFOs flagging privacy most often. (link)

PARTNERSHIPS

Carta Healthcare + Anthropic: Carta launched a Claude-powered hybrid data intelligence platform for registry abstraction and analytics, combining AI with clinician review. Early results show up to 66% faster abstraction and 50% lower abstraction costs for health system partners. (link)

Innovaccer + Community Care of North Carolina: Innovaccer signed a five-year partnership with CCNC to deploy its Healthcare Intelligence Cloud for predictive analytics, AI-driven outreach, and value-based care performance tools. (link)

Microsoft + Strolll + Cleveland Clinic: Microsoft and Strolll worked with Cleveland Clinic to develop an Azure-powered mixed reality tool to help Parkinson’s patients manage gait freezing at home. (link)

Deal Desk 💰

Spotlight on latest capital raises, M&A, and investments…

FUNDING

OpenEvidence, a Miami-based ChatGPT for clinicians, raised $250M at a $12B valuation led by Thrive Capital and DST. (link)

Tandem, an AI for perscipritons startup, is raising $100M led by Accel. (link)

AnswersNow, a Richmond, Va.-based provider of virtual applied behavioral analysis therapy, raised $40M in Series B funding. HealthQuest Capital led, joined by insiders Left Lane Capital, and Owl Ventures. (link)

BrightInsight, a maker of companion apps for pharma, raised $13M from existing and new investors including Eclipse, General Catalyst, Insight Partners, Mayo Clinic, and New Leaf Venture Partners. (link)

Biomakers, an AI-native precision oncology platform, raised $8M from Labcorp Venture Fund, Oncology Ventures, Endurance28, Zentynel, Sonen Capital, and Sky High Fund. (link)

PraxisPro, a Houston, Texas-based AI platform designed for sales reps in life sciences, raised $6M in seed funding. AlleyCorp led the round. (link)

Claim Health, an NYC-based AI-powered revenue operations platform for post-acute care, raised $4.4M in seed funding. Maverick Ventures led the round and was joined by Peak XV, Y Combinator, DHVP, and others. (link)

GRANTS

H1000 Initiative: Gates Foundation and OpenAI are committing $50M to help African countries scale AI in primary healthcare with hands-on technical support. (link)

UT Health Austin: A new $100M gift is powering UT’s plan to build an “AI-native” hospital from the ground up, aiming for a 2030 opening. (link)

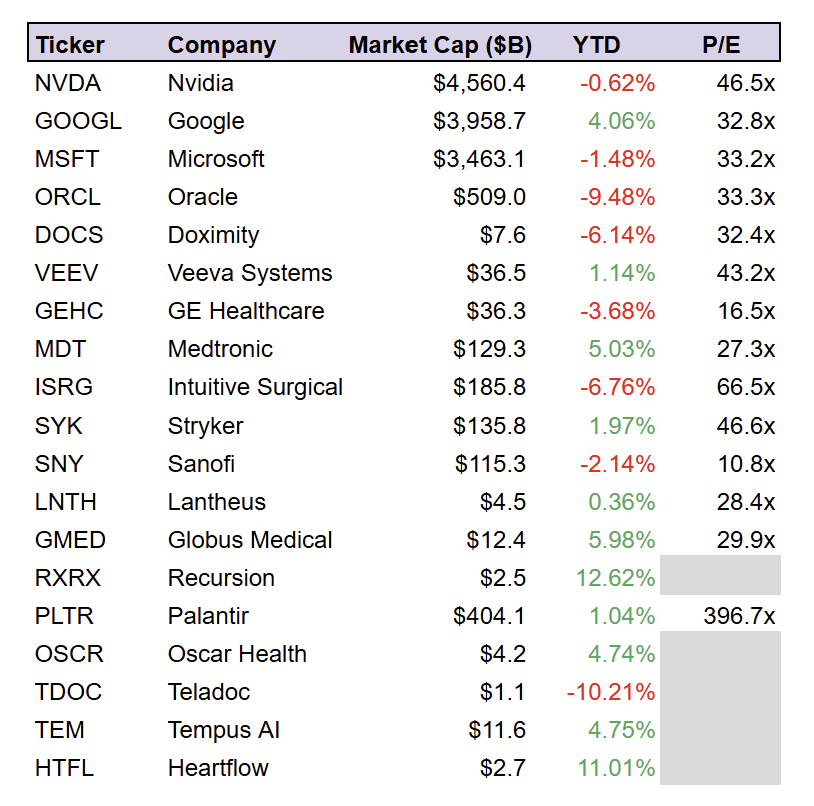

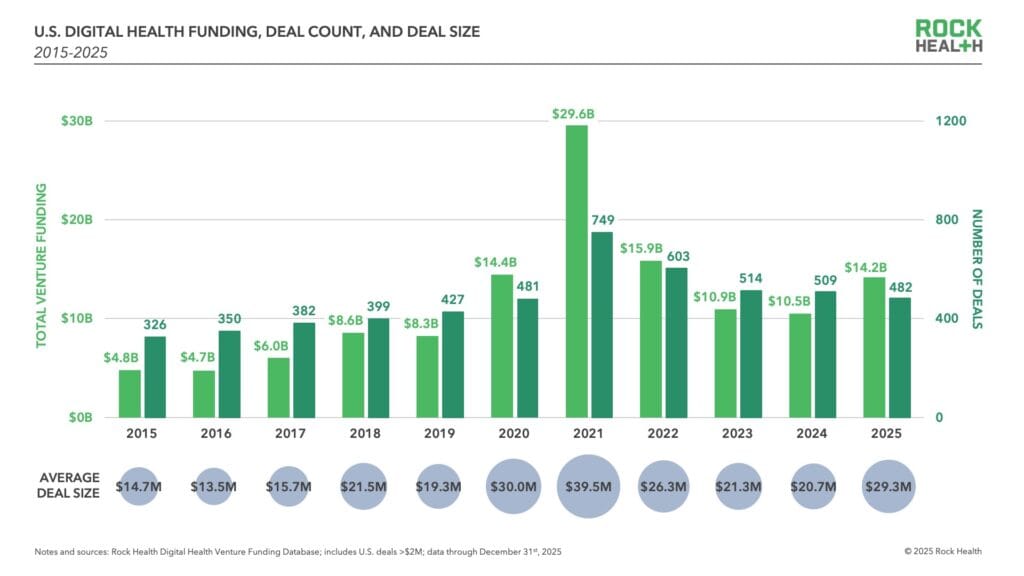

Stay on top of the healthcare AI market and track our portfolio 📈

as of 1/25/26

Other Relevant News 🔍

News, podcasts, blogs, tweets, resources, etc…

AI Job Opportunities 💼

Explore our AI Job Board or contact us to feature roles in our newsletter…

Visuals of the Week 📸

Funny memes, cool pics, and interesting data from around the web…

That’s it for this week friends! Back to reading — I’ll see you next week.

Stay classy,

PS. I write this newsletter for you. So if you have any suggestions or questions, feel free to reply to this email and let me know

How was this week's newsletter? Tap your choice below👇