Morning, friends —

Here’s what we have this week:

JPM 2026 health AI review

The state of clinical AI

AI in hospitals: what works, what breaks

15 new tools/partnerships, 9 funding updates, new AI jobs & link-worthy content

Read time: 5 minutes

Our Picks ✨

Highlights if you’ve only got 2 minutes…

1/

JPM 2026 health AI review

JPM 2026 hit San Francisco with agentic AI and clinical workflow copilots leading the week’s biggest themes. Here are the top additional AI headlines we didn’t already cover last week (OpenAI + Torch acquisition, Hippocratic AI + Grove AI acquisition, Abridge + Availity partnership, Anthropic for Healthcare):

NVIDIA and Lilly launch $1B AI co-innovation lab for drug discovery: NVIDIA and Eli Lilly announced a Bay Area AI lab built on NVIDIA BioNeMo and next-gen infrastructure, with plans to invest up to $1B over 5 years to accelerate drug discovery using agentic wet labs, frontier models, robotics, and digital twins.

Waystar goes agentic for the autonomous revenue cycle: Waystar unveiled agentic AI capabilities to automate more end-to-end revenue cycle work, with a long-term push toward an “autonomous” claims and payments platform.

OpenEvidence makes the case for “medical super-intelligence”: OpenEvidence pitched a future of subspecialist AI agents (“digital twins”) collaborating on complex cases, and claimed rapid clinician adoption at national scale.

Rock Health: AI took the lion’s share of 2025 digital health funding: Rock Health reported $14.2B in 2025 funding, with AI-enabled companies capturing the majority of dollars.

Elation Health embeds Anthropic’s Claude into the EHR: Elation integrated Claude to generate chart summaries and clinical insights from longitudinal patient data, aiming to reduce prep time and cognitive load in primary care workflows.

CommonSpirit scales operational AI with measurable value: CommonSpirit said it has deployed 242 AI tools generating $100M in annual value, paired with workforce upskilling efforts.

AdventHealth expands AI use cases and smart room tech: AdventHealth highlighted 80 AI use cases and a $60M smart room rollout across 13,000 rooms to modernize inpatient and ED care.

Tempus expands precision oncology partnerships: Tempus partnered with NYU Langone and Northwestern Medicine to broaden access to genomic testing and deepen longitudinal cancer profiling.

Teladoc previews AI-enabled interventions for 2026: Teladoc said it’s adding AI models to identify trends and trigger interventions, alongside deeper connected device integrations.

Hackensack Meridian taps Google for an AI platform: Hackensack Meridian cited a Google partnership focused on AI efforts like patient experience and clinician burnout.

UCSF rolls out ChatGPT Enterprise with 90 AI tools in the pipeline: UCSF leaders said they’re deploying ChatGPT Enterprise broadly while managing a large queue of AI tools through governance and safety-focused scaling.

Amgen shifts from hundreds of AI pilots to a few major bets: Amgen leaders said they’re prioritizing a small number of high-impact AI initiatives, backed by upskilling and change management, to avoid “pilot purgatory.”

Omada boosts AI across its platform alongside GLP-1 care growth: Omada said it’s advancing AI-driven capabilities as part of its between-visit model, while expanding GLP-1-related offerings and reporting strong 2025 growth.

(link)

2/

The state of clinical AI

The State of Clinical AI Report 2026 offers one of the clearest reality checks yet on how AI is actually performing in medicine. Produced by the Stanford Harvard ARISE network, the report steps back from product launches and benchmarks to ask a harder question: where does clinical AI truly hold up once it leaves the lab.

The takeaway is nuanced. Models are making real progress in prediction at scale, like spotting patient deterioration early or forecasting disease risk across millions of records. But performance often drops in messy, real-world settings where information is incomplete and uncertainty matters. Many studies still rely on exam-style questions that miss how care actually works.

The strongest evidence points to AI working best as a teammate, not a replacement. Human plus AI consistently outperforms either alone, but only when workflows, oversight, and failure modes are designed intentionally. According to ARISE, The next phase of clinical AI will be less about smarter models and more about better evaluation, safer deployment, and proof that outcomes actually improve — which is something we’ve been saying for a while. (link)(longer summary)

PS. Many of the researchers behind this report also teach in Stanford HAILS (AI in Healthcare Leadership & Strategy), a one-month hybrid program for healthcare leaders moving AI from concept to adoption. It delivers practical frameworks for non-clinical operators to evaluate AI, align teams, and scale responsibly.

Learn from Stanford and Harvard faculty alongside Silicon Valley healthcare AI leaders from OpenAI, Google, and the FDA. 👉 Register for the Feb 13 info session, or apply here.

3/

AI in hospitals: what works, what breaks

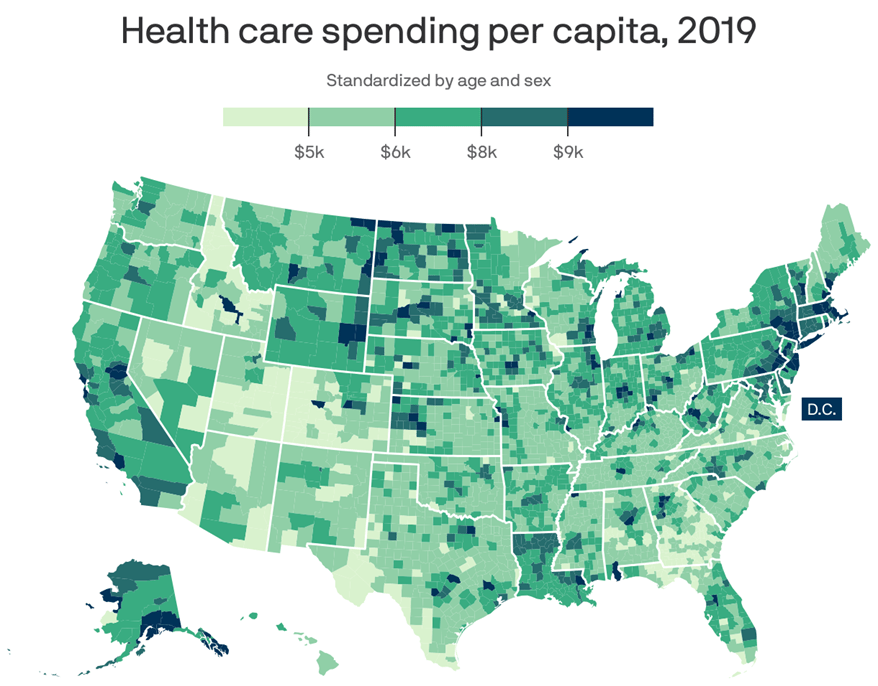

A new WSJ article highlights how hospitals are quickly becoming the real-world test bed for what AI can and cannot do in medicine. Adoption is accelerating fast. About 27% of health systems now pay for commercial AI tools, triple the rate across the broader economy. The biggest gains are showing up in unglamorous but critical work like radiology reporting, clinical documentation, call centers, and insurance appeals. At Northwestern Medicine, AI cut radiology read times nearly in half and helped surface missed findings in scans. At Mount Sinai, AI-assisted appeals boosted overturned denials and added roughly $12M in annual revenue.

At the same time, limits are clear. Models still hallucinate, some tools increase editing burden, and clinicians worry about deskilling and overtrust. The takeaway is in line with the ARISE state of clinical AI report: AI works best as a second set of eyes, not a replacement. Hospitals are learning where it adds leverage and where humans still matter most. (link)

Tools & Partnerships 🔧

Latest on business, consumer, and clinical healthcare AI tools and partnerships…

TOOLS

myQMS.ai reduced quality documentation review cycle time by ~75%: A global med tech team piloted myQMS.ai to automatically audit quality records against internal procedures and regulations, cutting review time from 6 hours to 1.5 hours while surfacing compliance gaps and improving audit readiness. (link)*

Google updates MedGemma and releases MedASR tools: Google launched MedGemma 1.5 with stronger performance for medical records and imaging tasks, plus an open MedASR speech-to-text model designed for clinical workflows and offline use. (link)

JAMA study links AI scribes to higher clinician revenue: UCSF Health found physicians using AI scribes generated 5.8% more weekly RVUs and 2.8% higher visit volume, translating to about $3,000 more revenue per physician per year without increasing denials. (link)

AI learns from 1M species to design new medicine: UK startup Basecamp Research introduced Eden, an AI model family trained on evolutionary and DNA data across 1M species, reporting 63% functional results for genetic disease targets and 97% effectiveness in new antibiotic candidates. (link)

Deloitte survey: 93% of health plan leaders expect AI to improve prior auth: A Deloitte survey found most health plan executives believe AI will help reduce prior authorization friction, signaling growing payer investment in automation across approvals and utilization management. (link)

Paragon Health Institute launches AI policy arm: Conservative think tank Paragon Health Institute created a new AI-focused policy group to shape healthcare AI regulation, governance, and oversight debates at the federal level. (link)

Mass General Brigham builds autonomous AI for cognitive screening: MGB developed an AI system that reviews routine clinical notes to flag cognitive impairment, hitting 98% specificity across 3,300 notes and using five AI agents to debate findings before a final decision. (link)

Neko Health expands to the U.S. starting in New York: Preventive health startup Neko Health announced it will launch in New York this spring, bringing its full-body scan experience to the U.S. with a growing waitlist and plans for broader expansion in 2026. (link)

Mass General Brigham expands AI-triaged virtual primary care: MGB plans to broaden Care Connect, a 24/7 virtual primary care platform triaged by an AI chatbot, to all insured patients in Massachusetts and New Hampshire starting in February. (link)

Hackensack Meridian rolls out AI for patient history intake: Hackensack Meridian Health launched an AI tool to streamline patient history collection and summarize key details for clinicians, reducing manual chart review. (link)

DiMe launches initiative to evaluate AI care navigation: DiMe convened health systems, payers, patient groups, and tech vendors to define evidence-based standards for AI-enabled care journeys, with plans to open-source evaluation frameworks and implementation roadmaps. (link)

PARTNERSHIPS

University of Texas System + Qualified Health: The UT System is deploying Qualified Health’s generative AI platform enterprise-wide, including a HIPAA-compliant chat tool and productivity agents for clinicians and staff. (link)

Aultman Health System + Nabla + Oracle Health: Aultman integrated Nabla’s ambient AI into its Oracle Health EHR to reduce documentation time across inpatient and outpatient settings. (link)

UCHealth + Abridge: UCHealth is expanding Abridge’s AI scribe to 2,000 providers to scale ambient documentation across the system. (link)

Inova Health + Notable: Inova Health is adopting Notable’s AI platform, starting with documentation requests, denials management, and closed-loop referral workflows. (link)

*Sponsored Listing

Deal Desk 💰

Spotlight on latest capital raises, M&A, and investments…

FUNDING

Merge Labs, a brain computer interface company, raised a $252M seed round ($850M valuation) from OpenAI, Bain Capital, Interface Fund and Fifty Years. (link)

Proxima, an NYC-based AI-powered drug discovery platform for proximity therapeutics, raised $80M in seed funding. DCVC led the round and was joined by NVentures, Braidwell, Roivant, AIX Ventures, and others. (link)

VieCure, an AI platform for community oncology clinics, raised $43M. The round was led by led by the co-founder of Danaher and Northpond Ventures. (link)

Juvena Therapeutics, a Redwood City, Calif.-based AI-powered regenerative biologics platform, raised $33.5M in Series B funding. Bison Ventures led the round. (link)

Vista AI, a Palo Alto, Calif.-based provider of MRI scanning software, raised $29.5M in Series B funding from Cedars-Sinai, Intermountain Health, Uni. of Utah Hospital System, Temple Uni., Tampa General Hospital, Khosla Ventures, and Bold Brain Capital. (link)

Converge Bio, a biotech AI platform, raised $25M in Series A funding from Bessemer Venture Partners. TLV Partners, and Vintage Investment Partners. (link)

RISA Labs, a Palo Alto, Calif.-based developer of an AI operating system designed for oncology, raised $11.1M in Series A funding. Cencora Ventures and Optum Ventures led the round. (link)

Allos AI, an Oxford, U.K.-based AI-powered drug development platform, raised $5M in seed funding. Oxford Science Enterprises led the round and was joined by Habico Invest and others. (link)

MERGERS & ACQUISITIONS

Zelis + Rivet: Zelis, a payments and healthtech company, is acquiring Rivet to leverage its AI-powered revenue cycle analytics, improving visibility into claim payments and denial trends to enable smarter collaboration, fewer inquiries, and higher first-time claim success. (link)

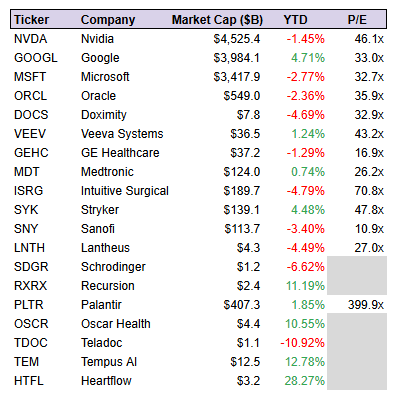

Stay on top of the healthcare AI market and track our portfolio 📈

as of 01/18/26

Other Relevant News 🔍

News, podcasts, blogs, tweets, resources, etc…

AI Job Opportunities 💼

Explore our AI Job Board or contact us to feature roles in our newsletter…

Visuals of the Week 📸

Funny memes, cool pics, and interesting data from around the web…

me pulling together the newsletter

That’s it for this week friends! Back to reading — I’ll see you next week.

Stay classy,

PS. I write this newsletter for you. So if you have any suggestions or questions, feel free to reply to this email and let me know

How was this week's newsletter? Tap your choice below👇